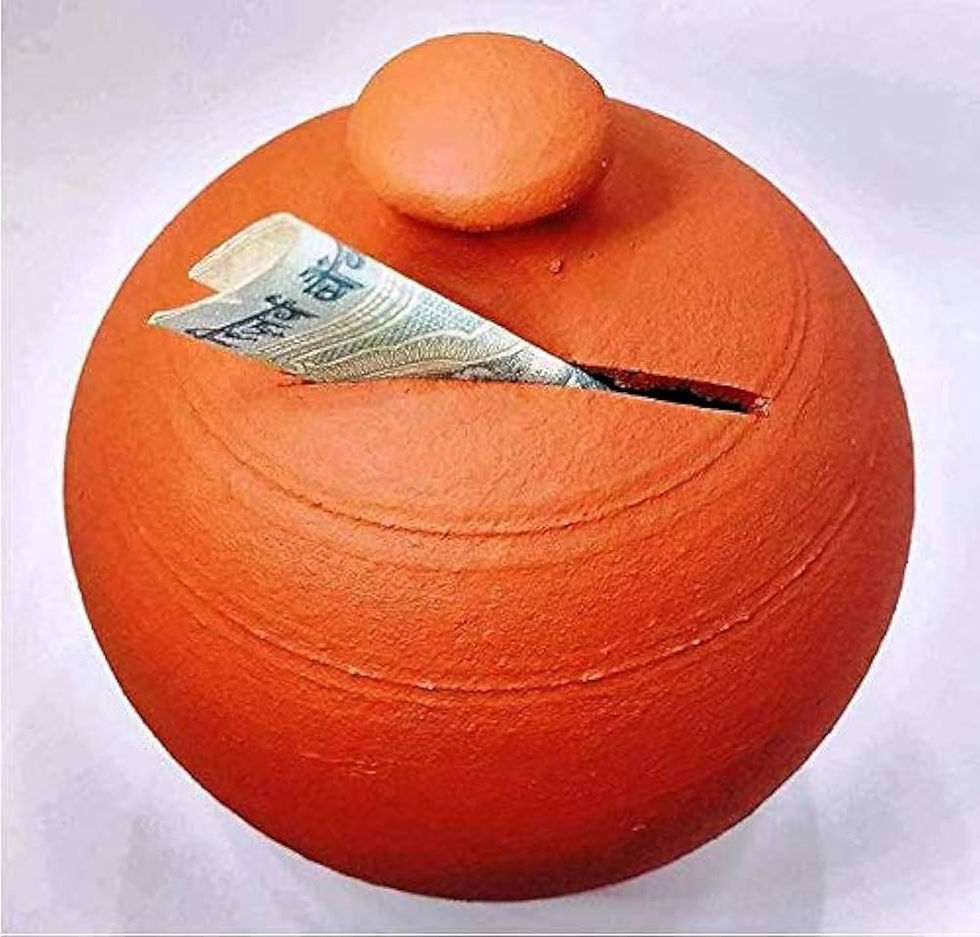

The “Gullak” of the new times.

- M P

- Jul 18, 2024

- 2 min read

Updated: Jul 20, 2024

“Gullak”, a colloquial word for a piggy bank.

When we were kids, the modest clay gullak had met its fancier plastic version, with ugly designs that complimented our lack of taste as middle-class kids, and the absence of any choice in the gifts we got. Those were the 80’s.

The whole purpose of the gullak was to save money, a standard practice in any family to condition the future generations to prepare for a ‘rainy day”. The side effects of this were sprinkled in the form of guilt over every perceived luxury that I ever made in my life. It was sound financial advice for a generation that was coming to money after the liberalization of the economy in the 90’s. We were part of the growing ‘New India’, that was going to be lured by a thing called ‘The Brand’.

Our financial health came mostly from our parents, a rich sibling, the office accountant or a CA who filed out last minute tax returns. It was limited but mostly tried and tested. Fixed deposits, LIC and the buzz word SIP’s ate most of the little pie we had. The pie is bigger today and the resources umpteen to manage one's money and yet we see many Gen Z’s getting their "info" from TikTok.

Some of the trends I’ve heard about are “Cash Stuffing” ,”100 envelope”, “The No spend challenge” and “Long Budgeting”.

So, the "100 envelope" challenge is where you save a dollar more everyday for 30 days. It stars with $1 a day, $2 on the second and so on. "Cash stuffing" is basically putting money into envelopes and stashing it away for different categories like groceries, school fee etc. If you finish your money you needed to siphon it from another category.

Is it a reflection of this generation that the one trend that involved real envelopes didn’t get named after it, and the one that didn’t, did! I’ll never figure.

Coming back to the “No-spend challenge”. It is fortunately, as the name suggests, abstaining from spending money on non-essentials. And finally "Loud Budgeting" refers to sharing one's financial goals and hopes openly with the people in your life so that they can support you on the day you decide to cook instead of ordering in with friends.

These are the gullak’s of the new times. These financial fads compete with years of a boring wealth routine of regularly investing rather than just saving. But this is what is popular and easily accessible. Who is to blame ? With our attentions reduced to a meager 10 secs at a time, these byte sized life lessons are easy to understand and maybe help a generation not bogged by responsibilities just yet.

And for me, it’s a sweet reminder of the gullak, also a reminder to go back to the basics while you are budgeting things , try a little abstinence and sometimes just being young and keeping it simple, doing one thing at a time. On that note, maybe its time to buy myself a new Gullak, one for memories. Clearly the saving trends didnt get to this millennial.

Comments